Credit Union Drives Physical Visits and Auto Loan Applications Using Native Programmatic Ads With Simpli.fi

Brand Overview

• A regional credit union with more than 20 locations

• Wanted to increase the number of customers using its auto financing services

• Sought to generate appointment sign-ups, online loan applications, and in-person visits to its branches![]() Partner Overview

Partner Overview

• Digital marketing agency owned by a Midwestern broadcasting company

• Simpli.fi partner for more than seven years

• Wanted to use native programmatic ads to match the creative style of each publisher and generate a higher response rate

PROMOTING AUTO FINANCING SERVICES

As vehicle prices increase with limited impact on consumers’ willingness to buy (KBB), a credit union with more than 20 locations in eastern Indiana saw the perfect opportunity to promote its auto financing services to car buyers. It hoped to increase physical traffic to its branches, as well as drive traffic to its website to generate online loan applications and appointment bookings.

The credit union worked with the marketing agency arm of a popular broadcasting company that has partnered with Simpli.fi for more than seven years. The agency and the credit union decided to pair Simpli.fi’s precise targeting with native ads, which adjust in real-time to fit the look and feel of each publisher. These creatives blend in with the rest of the content on the publisher’s website or app and tend to improve campaign engagement by 20% to 60% when compared to display creatives.

Together, Simpli.fi and the agency chose to implement native and display creatives with both location-based and behavioral targeting to generate online and offline conversions.

IDENTIFYING VEHICLE SHOPPERS’ FOOT TRAFFIC TO THE CREDIT UNION

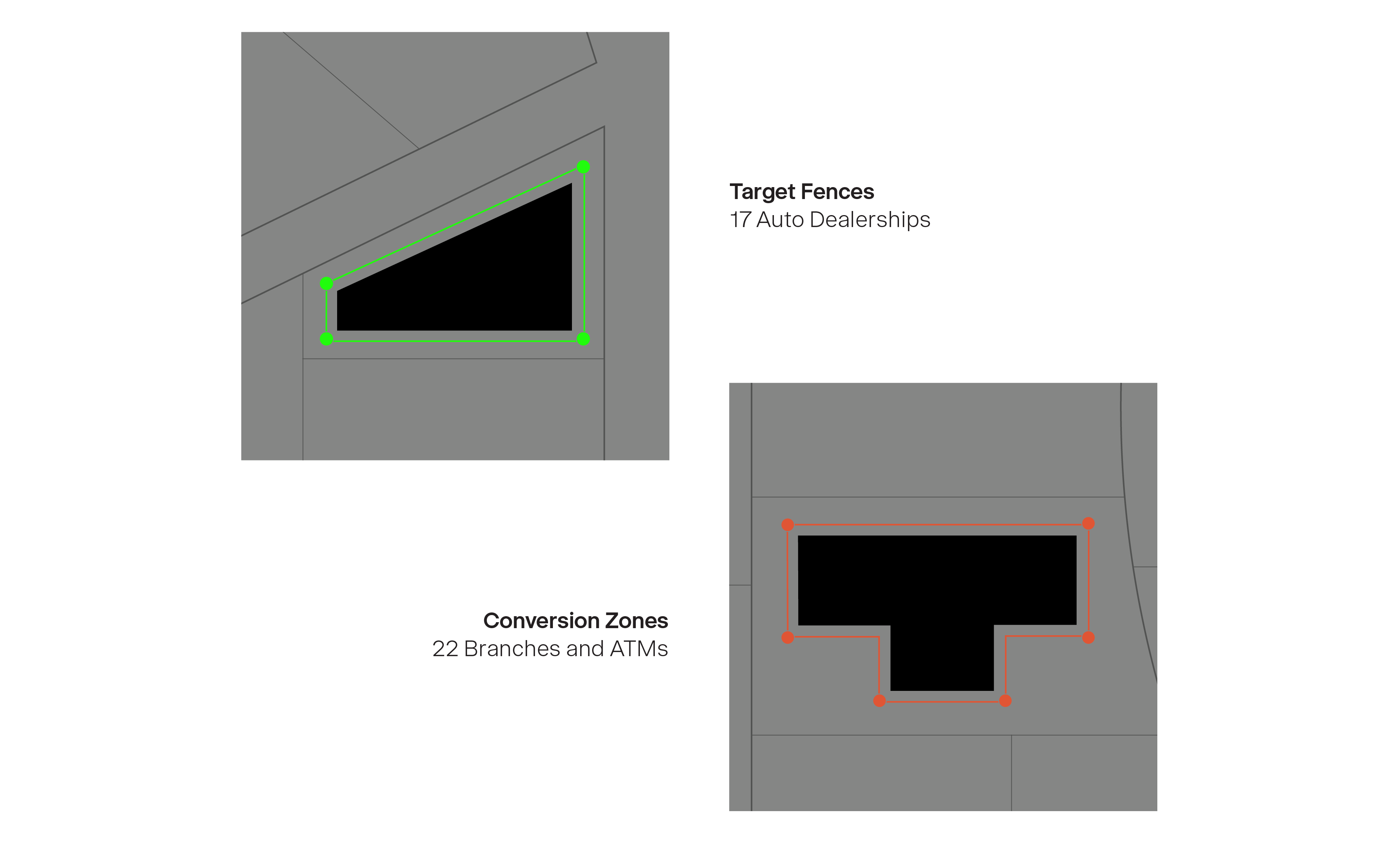

The credit union specifically wanted to target car shoppers in and near Fort Wayne, Indiana, so it supplied a list of 17 popular auto dealerships in that area. The Simpli.fi team drew target fences around each location, which enabled Simpli.fi to capture users as they visited the dealerships and retarget them with both native and display ads for up to 30 days.

The advertiser also sought to measure the number of targeted consumers who received an ad and later visited one of the credit union’s branches or ATMs. Therefore, Simpli.fi drew Conversion Zones around 22 of the credit union’s locations, enabling it to track foot-traffic conversions to its branches.

TARGETING BASED ON AUTO FINANCING INTENT

Simpli.fi and the agency set out to reach users who were actively researching the process of buying and financing vehicles. First, Simpli.fi implemented Search Retargeting and Keyword Contextual targeting tactics with native and display creatives to retarget users in the Fort Wayne metro based on the keywords they were searching and the content they were reading. The team deployed a custom keyword list of more than 1,800 relevant keywords.

The credit union took advantage of Simpli.fi’s recency settings to ensure that it was reaching users who were recently interested in financing a vehicle. Simpli.fi’s recency window represents the time frame during which a user can be retargeted after searching for a keyword, with options ranging from instantly to 30 days. Given that purchasing a vehicle typically involves a longer sales journey, Simpli.fi, the agency, and the advertiser chose to retarget users for up to 30 days.

Finally, Simpli.fi implemented Category Contextual targeting with display creatives to reach shoppers on webpages that were categorically relevant to the car buying process. This allowed the advertiser to reach consumers at the top of the sales funnel who were just beginning to shop for new vehicles.

MEASURING HIGH-VALUE ACTIONS

The credit union wanted to measure higher-value actions to identify the number of users who received an ad and then filled out an online auto loan application or booked an appointment with its loan officers. Therefore, the advertiser placed Simpli.fi pixels on its site, and Simpli.fi created multiple conversion audiences to measure these results.

RESULTS HIGHLIGHT NATIVE SUCCESS

Combined, the native and display creatives generated 1,314 physical visits to the credit union’s 22 branches and ATMs for a low Cost Per Visit (CPV) of $1.24 over the course of four months. They also generated 533 online applications, appointments, and website visits for a Cost Per Action (CPA) of $4.91.

The native creatives alone achieved a CPV of $0.77 and a CPA of $2.30, serving across a mix of websites and apps, including Poynter, TextNow, Food Network, the New York Times, and more. These results highlight the benefit of using creatives that adjust in real-time to fit the layout of the app or website, thus allowing the ads to blend in with the rest of the publisher’s content and making consumers more receptive to them.

Interested in Driving Performance With Simpli.fi’s Native Advertising Offering?

Fill out the form below, contact your Simpli.fi representative, or email us at hi@simpli.fi for next steps.

Relevant Posts For You